ACQUISITION FINANCING REQUEST

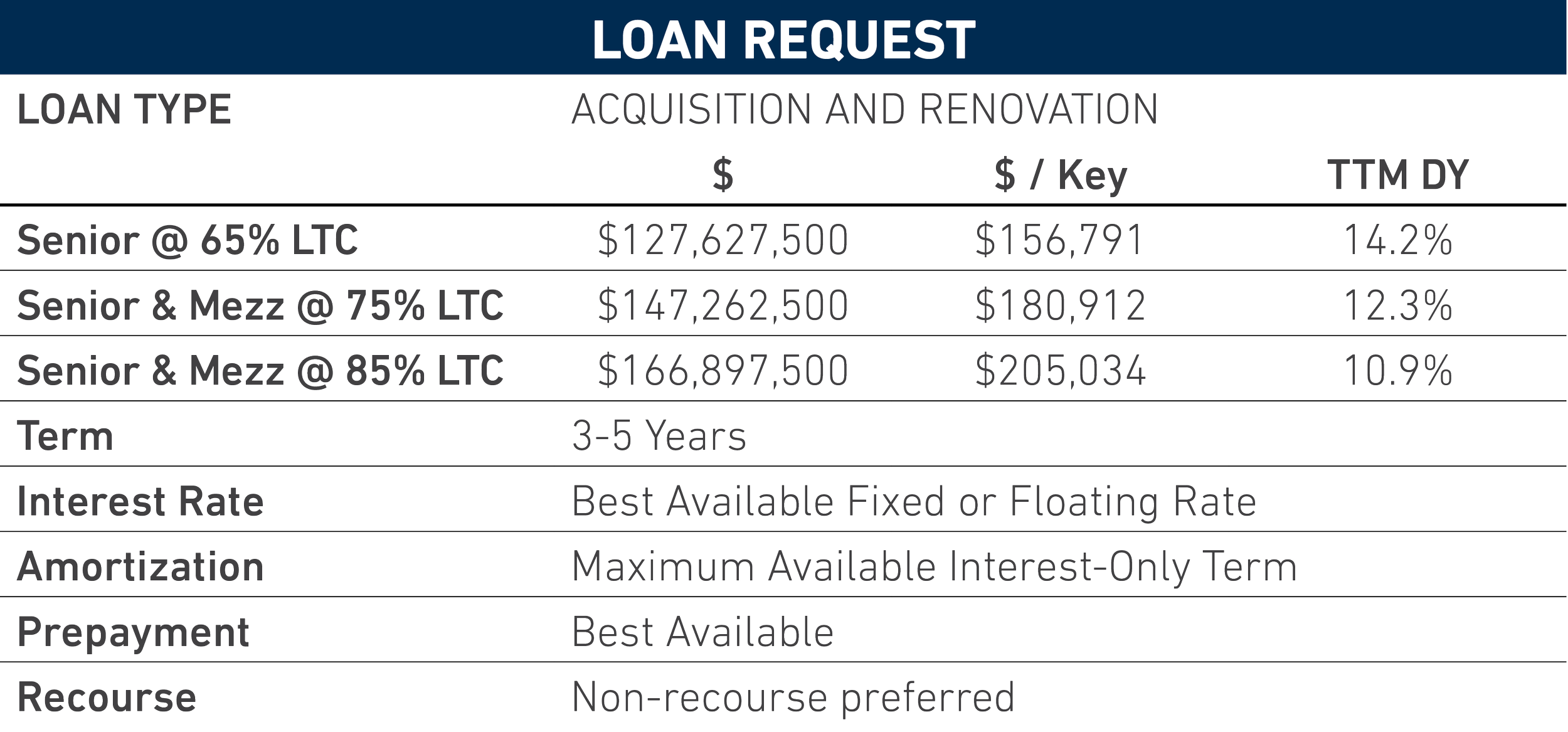

Hodges Ward Elliott (“HWE”) has been exclusively engaged by The Flacks Group (the “Sponsor” or “Borrower”) to obtain a 65.0% to 85.0% LTC ($128 million / $158,000 per key to $167 million / $205,000 per key) floating or fixed rate loan at the best available terms (the “Loan”) to finance the acquisition and renovation of the 814-key Hilton Orlando Lake Buena Vista – Disney Springs™ Area (the “Hotel” or “Property”). The Property is the closest hotel with a direct footbridge connection to Disney Springs, offering guests effortless access to over 150 world-class restaurants, shops, and entertainment venues. As an Official Walt Disney World Hotel, the Property capitalizes on its valuable affiliation with the world’s most visited theme park—attracting 50 million guests in 2024—by providing exclusive perks, including extended park hours, complimentary shuttle service, and immersive Disney-branded experiences.

This 10-story hotel boasts premium amenities, including two heated outdoor pools, a 24-hour fitness center, and arcade. With over 84,000 square feet of versatile event space—highlighted by three expansive ballrooms, all over 11,000 square feet, and 22 breakout rooms—the Property is perfectly suited for both corporate and social events. This is a rare opportunity to finance a premier hospitality asset in one of the nation’s most dynamic and high-performing lodging markets.

The Hotel is brand managed, thus not subject to a formal PIP, however the Sponsor is contemplating a comprehensive $35 million renovation encompassing public spaces, guest rooms, F&B, exterior and signage in order to enhance the Hotel’s positioning, conditional upon the ground lessor’s extension of the ground lease. The Sponsor has commenced discussions with Walt Disney Parks and Resorts, the fee-simple owner / ground lessor, regarding at minimum 12-year extension of the lease through at least January 1, 2071.

The Hilton Orlando Lake Buena Vista has performed exceptionally well, with August 2025 TTM NOI of $18,225,712 representing a 14.3% debt yield at 65% LTC, 12.4% at 75% LTC, and 10.9% at 85% LTC. As the 4th ranked hotel in Lake Buena Vista per TripAdvisor, the Property’s $154.40 RevPAR in the latest TTM period represents a 104.9% RevPAR penetration index to its competitive set which includes the highest rated hotels in the market. Following a comprehensive renovation, the Property is anticipated to achieve substantially higher rate, with Year 3 projected NOI of $24,050,067 equating to a 18.9%, 16.3%, and 14.4% DY at 65%, 75%, and 85% LTC, respectively.

FINANCING REQUEST

Historical & Projected Loan Performance

The Sponsor is seeking maximum available proceeds from either a single source or combination of senior debt plus mezzanine financing or preferred equity. The Hotel’s August 2025 TTM NOI of $18,225,712 representing a 14.3% debt yield at 65% LTC, 12.4% at 75% LTC, and 10.9% at 85% LTC. Tangible upside remains following the Sponsor’s planned $35mm renovation, with Year 3 projected NOI of $24,060,067 equating to a 18.9%, 16.3%, and 14.4% DY at 65%, 75%, and 85% LTC, respectively.

Accomplished Sponsorship with

Extensive Real Estate Experience

Founded and led by Michael Flacks since 1983, Flacks Group is a diversified holding company based in Miami, Florida with global asset value exceeding $4 billion, including $3 billion of commercial real estate. Flacks Group specializes in the acquisition and operational turnaround of medium-sized businesses predominantly in the manufacturing, industrial, processing and engineering sectors worldwide. The Sponsor also controls a growing real estate portfolio comprised of both operating assets and new developments in the U.S., U.K. and Germany.

Current business holdings include Pleuger Industries, No Nonsense Beauty and Artemyn Minerals which was acquired in July 2024. Current U.S. real estate holdings include the 132-unit multifamily development Nottinghill Davenport, FL that opened August 2024, the planned 350-unit multifamily development Nottinghill Lakeland, FL, and Seagate Industrial Park in Oklahoma City, OK. Current international real estate holdings include Hamburg Industrial Park and Bavaria Industrial Park in Germany, as well as the 500-acre Eagle’s Cliff development site in the U.K.

Investment Highlights

Ideal Location Inside Walt Disney World

The Hotel is ideally located just off I-4 inside Walt Disney World Resort on Hotel Plaza Boulevard. The location has significant advantages which include high visibility from I-4, an arrivals experience which includes passing through the iconic Mickey Mouse “Welcome to Walt Disney World” sign and the beautiful, landscaped grounds of Hotel Plaza Boulevard, and exclusive recognition as an Official Disney Hotel (see highlight below).

Closest Hotel to Disney Springs

The Property is the closest hotel to Disney Springs. Guests are only a short walk away from this waterfront, mixed-use entertainment and retail complex. Disney spent $1.5 billion from 2013 to 2016 redeveloping and rebranding the area as Disney Springs. Orlando is the #1 visited city in the world with 75 million visitors per year. Walt Disney World is the #1 visited resort in Orlando with 58 million visitors per year. Disney Springs is the #1 visited destination within Walt Disney World.

Official Disney Hotel: Ground Lease as Licensing Fee

The hotels on Hotel Plaza Boulevard all rest on ground parcels leased from Disney. As such, they are designated Official Walt Disney World Hotels. Guests of the Hilton receive exclusive amenities such as complimentary shuttle service to Disney parks, extra park hours, Disney themed displays within the Hotel, and the exclusive ability to host events with costumed Disney characters like Mickey and Minnie Mouse. These advantages allow the Hotel to achieve higher revenues than comparable hotels just outside the gates of Disney.

Power Of the Parks

Out of Orlando’s 74 million annual visitors, 50 million visit Walt Disney World. Disney attracts roughly four times the number of visitors than Orlando’s Universal Parks. The Hotel is located only 15-minutes from Universal, including Epic Universe, an entirely new amusement park opened in May 2025. At 750 acres, this new theme park is the size of the three existing Universal parks combined. It is by far, the single largest demand generator to deliver in the Orlando market in a generation. The openings of theme park sections like Universal’s Wizarding World of Harry Potter (2010) and Disney’s Star Wars: Galaxy’s Edge (2019) had a significant market-wide impact and Epic Universe – a new, full-scale theme park featuring multiple sections such as Super Nintendo World, Universal Monster, and How to Train Your Dragon Isle – has considerably boosted demand since opening.

Universal’s Epic Universe

Just 15 minutes from the Hotel, Universal’s newest 750-acre park expansion, Universal’s Epic Universe, opened on May 22nd, 2025. The park is anchored by Super Nintendo World which has been a tremendous success at Universal Studios Japan. Univesal's Epic Universe attracted millions in its first season and boosted local hospitality demand by an estimated 10-15% in Q3 2025.

Management Enhanced by Hilton

As discussed above, the majority of supertanker hotels are brand-managed (75%) in order to take advantage of the brands’ national group sales efforts. Brand management also allows for complexing certain functions with other nearby hotels. The Hilton Orlando Lake Buena Vista benefits from complexing with the nearby Hilton Buena Vista Palace. Complexed functions include GM, F&B operations, and the Sales/Events team. Furthermore, brand management avoids a PIP requirement upon sale and places responsibility for FF&E upgrade funding onto the management company’s utilization of FF&E reserve funds. A purchaser can acquire the Hotel subject to the management contract and maximize renovation flexibility after acquisition.

Supertanker Dynamics

Supertanker Analysis

Properties with 800 or more keys can be referred to as “Supertankers.” These properties, due to today’s market conditions, benefit from limited supply driven by high barriers to entry. Supertanker hotels typically enjoy significant economies of scale, enabling them to achieve higher margins relative to RevPAR. Approximately 75% of these hotels are brand-managed, leveraging the brands’ nationwide sales and marketing efforts to maximize reach. The Hilton Orlando Resort Lake Buena Vista – Disney Springs Area capitalizes on both leisure and corporate demand drivers, making it a prime example of a Supertanker property.

The Supply of Supertanker Hotels Has Slowed

Between 2010 and 2015, 2 to 6 supertanker hotels were typically built each year. However, since 2015, construction has significantly slowed, with only 1 to 3 supertanker hotels being delivered annually. Notably, no supertanker hotels were completed in 2019, 2022, or 2024, reflecting the decreasing pace of new supply in this segment.